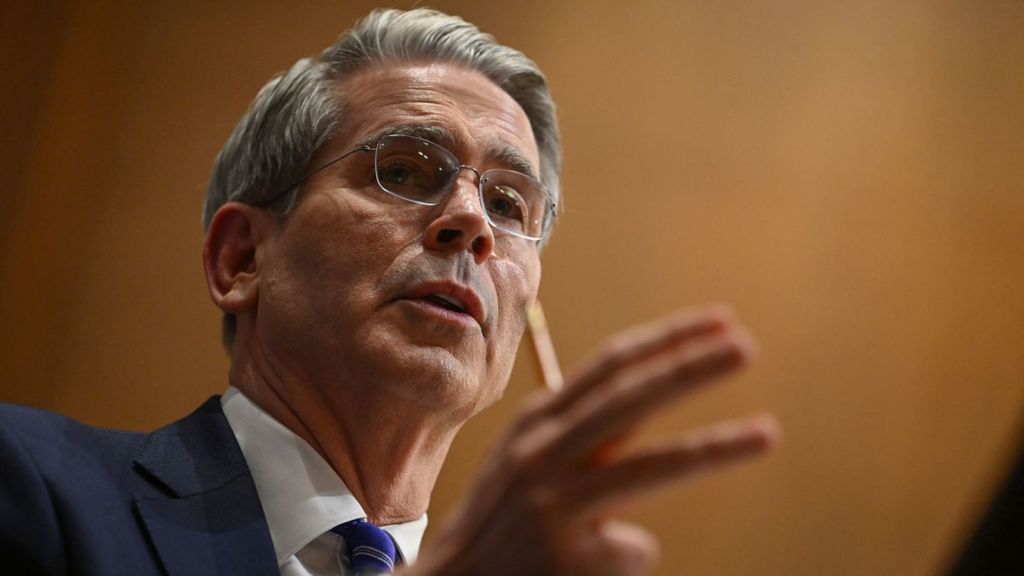

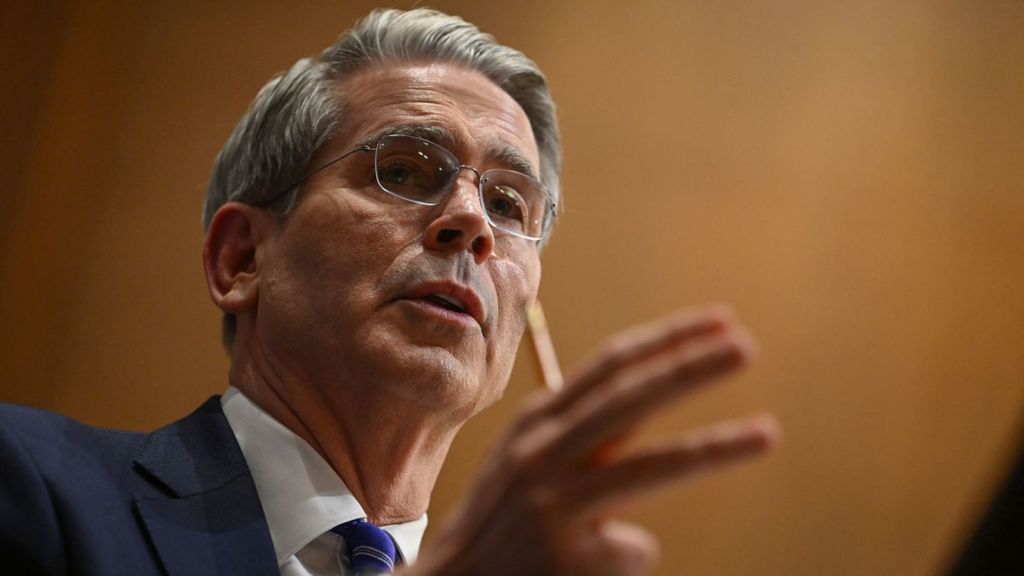

US Treasury Sec To Wall Street: If You Hate Crypto Rules, El Salvador Is Waiting

Treasury Secretary Scott Bessent put a spotlight on the growing rift between regulators and parts of the crypto industry this week, telling lawmakers that those who resist clear rules “should move to El Salvador.”

The line landed hard during a Senate Banking Committee hearing and was repeated across multiple news outlets as a sign the administration is pushing for firm oversight rather than tolerance for gray areas in markets.

Bessent’s Warning To Industry

Based on reports, Bessent called out what he described as a wing of crypto that would rather scuttle compromise than accept a legal framework.

His remarks came as senators debated the Electronic Asset Market Clarity Act, a bill meant to spell out how digital assets fit into existing banking and securities rules.

The episode followed recent moves by major players — including a high-profile platform stepping back from support for the bill — which lawmakers say chances for a quick fix.

Lawmakers And Lobbyists Take Sides

The hearing did not stay polite for long. Voices rose. Accusations flew. Some senators warned that unchecked stablecoin products could pull deposits out of banks, while crypto advocates argued that heavy-handed rules would stifle innovation.

Bessent that if firms prefer places with looser oversight they can seek them out, naming El Salvador as an example. That rhetorical nudge is more than a talking point — it’s a signal about market access: do business under US guardrails, or accept limits on participation.

What El Salvador Actually Offers

Reports note that El Salvador’s has shifted since it became the first country to make bitcoin legal tender. Lawmakers there approved changes to make BTC acceptance voluntary as part of an IMF-backed deal last year.

The move reduced the mandatory use of while the government said it would still hold and, on occasion, add to its reserves. Those choices mean El Salvador is not a simple “no rules” refuge, even if it appears friendlier to some crypto actors than the US.

Markets And Messaging

Traders watch words like these. Markets respond to certainty, and clarity tends to calm them. When policymakers argue publicly, volatility can spike.

At the same time, a clear path for regulation would let banks plan products and let crypto firms design services that can be sold widely, not just in select jurisdictions.

Some industry executives are lobbying for carve-outs; others want full regulatory recognition. The tension is real and it will shape who stays and who sails elsewhere.

Featured image from Unsplash, chart from TradingView