Best Crypto Presales 2026: Analysts Flag Early Projects Worth Tracking

Crypto is kicking off February 2026 with a distinct chill in the air. The tape is doing exactly what it always does during drawdowns: punishing leverage first, then forcing narratives to prove they have actual demand.

At the time of writing, $BTC hovers around $66,805 and $ETH struggles near $1,895, per CoinGecko, following a sharp multi-month retrace from late-2025 highs. () But price is just the headline. The real signal is positioning. When the market de-risks this aggressively, liquidity fragments, spreads widen, and “beta” plays (memecoins, small caps) stop being forgiving.

ETF flows tell a similar story. Data tracked by SoSoValue indicates U.S. spot BTC ETFs recently endured a $1.33B net outflow week—the worst bleed since February 2025—even though flows managed a notable one-day rebound early this month. () Meanwhile, mainstream coverage notes that the post-2025 euphoria has given way to deleveraging and renewed regulatory friction. It’s the classic cocktail that squeezes speculative excess out of the system. ()

Why does this matter for the “best crypto presales 2026” conversation?

Because presales don’t exist in a vacuum. Gravity applies here too. However, capital tends to concentrate around two specific themes that survive risk-off regimes: infrastructure and distribution. If smart money is going to take early-stage risk right now, it wants a defensible thesis—scaling, settlement, and credible user demand. Which raises the uncomfortable question: where is crypto’s next useful throughput coming from—especially on BTC?

BTC L2s Take Center Stage As Execution Moves Off L1

The most actionable presale theme in 2026 is simple: BTC remains the settlement layer, but the actual work is moving elsewhere.

Lightning continues to anchor the payments narrative. Capacity metrics hit records around 5,637 BTC in late 2025, suggesting that “BTC as a medium of exchange” is compounding quietly even while price sentiment sours. () In the same vein, Stacks has pushed the “programmable BTC” thesis forward via its Nakamoto upgrade milestones. ()

But here’s what most coverage misses: when markets draw down, builders don’t stop. They consolidate. Payments networks (Lightning) and execution environments (BTC L2s) are currently fighting for the same prize—BTC liquidity that actually does something.

That’s where enters the fray.

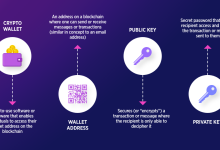

The project pitches itself as “THE FIRST EVER BITCOIN LAYER 2” with Solana Virtual Machine (SVM) integration. The goal? Deliver extremely low-latency L2 processing and fast smart contract execution while relying on BTC L1 for final settlement. The architecture is modular—BTC settles, the SVM executes—with a decentralized canonical bridge for BTC transfers. (Yes, combining BTC security with Solana speed is an ambitious play).

The risk? Execution speed narratives can be intoxicating. Bridging design and sequencer assumptions—BTC Hyper utilizes a single trusted sequencer with periodic L1 state anchoring—are where serious investors will focus their due diligence. Fast is easy to market; resilient is hard to ship.

Review BTC Hyper’s L2 thesis.

BTC Hyper ($HYPER) Presale Metrics: Big Raise, Clear Narrative

In this environment, metrics speak louder than whitepapers. Presales that survive 2026 typically show sustained fundraising and a narrative that aligns with the market’s “infrastructure-first” bias.

On the fundraising front, BTC Hyper’s numbers aren’t small. According to the official presale page, the project has raised $31,257,822.88, with tokens priced at $0.0136751. In a market actively repricing risk, these figures suggest the bid isn’t purely momentum—there’s conviction behind the theme.

We’re also seeing early “smart money” movement. Etherscan records show 2 whale wallets have accumulated $116K, with the largest single transaction of $63K occurring on Jan 15, 2026. () While whale buys aren’t a guarantee of future performance, in a skittish tape, they often function as a sentiment catalyst.

Utility-wise, BTC Hyper is targeting:

- High-speed payments in wrapped BTC with negligible fees.

- DeFi primitives (swaps, lending, staking protocols).

- NFT and gaming dApps, supported by a developer SDK/API in Rust.

On the incentive side, staking is advertised with high APY (rate not disclosed), featuring immediate staking after TGE and a 7-day vesting period for presale stakers, plus rewards tied to governance participation.

For traders building a 2026 watchlist, here are the key questions: 1) Can the bridge model earn trust under stress? 2) Will developers actually deploy SVM apps, or will it remain theoretical? 3) Does BTC liquidity migrate into on-chain apps as ETF flows stabilize?

If the macro clouds part and BTC’s ecosystem narrative rotates from “hold” to “use,” BTC Hyper is positioned squarely in that slipstream.

This article is not financial advice; crypto is volatile, presales are high risk, and smart-contract/bridge designs can fail. Always do your own research.

Key Takeaways

- $BTC (~$66,805) and $ETH (~$1,895) signal a risk-off market where leverage unwinds faster than narratives can rebuild.

- ETF flow whiplash (heavy outflows followed by rebounds) suggests institutional positioning is tactical, not a blind “up only” bet.

- BTC scaling is fragmenting into payments (Lightning) and execution layers (L2s), putting “productive BTC” back in focus.

- BTC Hyper targets this shift by bringing fast SVM execution to a BTC-settled L2 environment.